Our target criteria

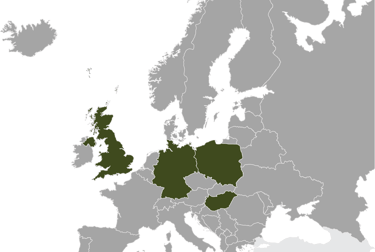

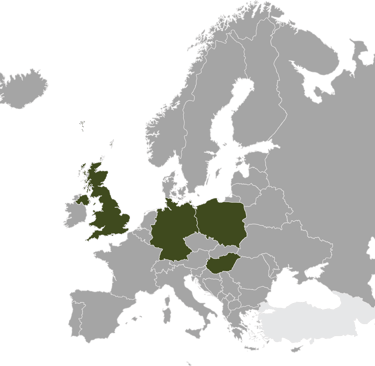

Seltected geographies

UK

The UK is a well-established hub for Private Equity, offering a mature and highly developed market. It benefits from a robust regulatory framework, stable political environment, and access to capital. London, as a global financial center, provides a strong ecosystem for deal-making, fundraising, and exits. Key sectors include technology, financial services, healthcare, and consumer goods. The UK also serves as a gateway to broader European and global markets, making it attractive for international investors.

Germany

Germany is the largest economy in Europe and a key destination for Private Equity investments. The country offers a strong industrial base, with a focus on manufacturing, automotive, engineering, and technology. Family-owned Mittelstand companies (small and mid-sized firms) present numerous opportunities for PE firms, especially in succession planning and growth capital. Germany’s economic stability and central location in Europe make it a strategic investment target.

Poland

Poland is one of the fastest-growing economies in Central and Eastern Europe, offering significant opportunities for Private Equity. With a young, skilled workforce, a burgeoning technology sector, and strong domestic consumption, Poland presents attractive growth prospects. PE activity has been increasing, particularly in sectors like technology, e-commerce, manufacturing, and infrastructure. Poland also benefits from its strategic location and EU membership, offering access to broader European markets.

Hungary

Hungary has seen a steady rise in Private Equity interest, particularly in sectors such as manufacturing, IT, and real estate. The country’s competitive labor costs and favorable business environment, supported by government incentives, make it an attractive location for mid-sized PE deals. Hungary’s central location within Europe, combined with its strong export-driven economy, presents opportunities for cross-border investments. However, investors must be mindful of political risks and regulatory changes.

Sector focus

Industrial & Manufacturing

Consumer Products

Healthcare

Size

Seller profile

Well-established, family-run businesses with lack of clear succession plan